Snoqualmie Pass Real Estate, Snoqualmie

Pass Properties, Snoqualmie Pass Homes, Snoqualmie Pass Lots, North Bend Real

Estate, Snoqualmie Real Estate, Suncadia Real Estate, http://www.snoqualmiepassliving.com

Using real estate to secure your financial future isn't for the faint of heart, but if done right, it has a lot to offer. USA TODAY

For several years, home sellers have had the upper hand as they haggled with buyers over price. In 2018, it might at least be more of a fair fight.

The nation’s hot housing market could cool off next year as rising costs and tax-law changes discourage some buyers even as more homeowners put their homes up for sale.

The shift in bargaining power won't be dramatic. Many sizzling housing markets on the West and East Coasts will continue to see solidly rising prices, economists say. Yet the pace of the run-up will likely slow as a market that has long favored sellers evens out somewhat.

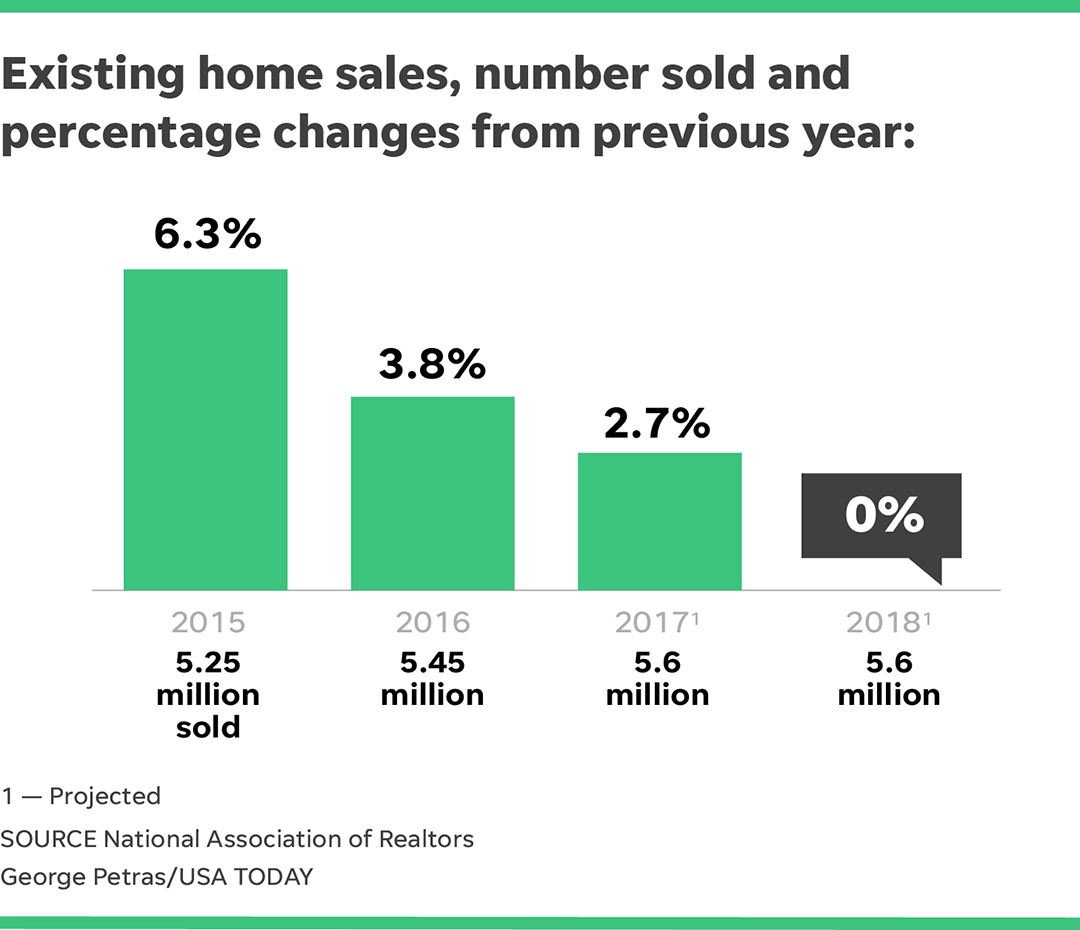

“Existing home sales will probably not make gains in 2018 even as the economy creates more jobs,” says Lawrence Yun, chief economist of the National Association of Realtors. If his forecast bears out, it would mark the first year of flat or falling home sales since the housing crash 11 years ago.

Existing home sales are projected to be unchanged at about 5.6 million after rising 6.3%, 3.8% and 2.7%, respectively, each of the past three years ending in 2017, Yun says. The median home price, he predicts, will edge up about 2% to $253,000 after averaging 6% jumps since 2015.

DEMAND COULD COOL

In many cities, buyers haven't been in the driver's seat since the launch of the home price recovery in 2012. And there hasn’t been much relief for house hunters recently. In November, existing home sales hit an 11-year high despite just a 3.4-month supply of homes on the market, the lowest since 1999. The skimpy inventory has driven up the median home value by 48% since 2011.

Healthy job and income growth has fueled demand for houses, including from more Millennial first-time buyers. At the same time, many Baby Boomers are staying in their homes instead of selling and flocking to retirement havens. Investors -- who buy houses to rent out or flip for a profit rather than to occupy -- also have held onto their property, reaping lucrative rents and sharp price gains, says Ralph McLaughlin, chief economist of real estate research firm Trulia. And new home construction has been curtailed by shortages of workers and available lots.

But the tide may be turning. The climbing prices, combined with stagnant wages, are making purchases less feasible for many prospective buyers, Yun says. And after falling this year, 30-year mortgage rates should increase from 3.9% to near 5% by the end of 2018, Yun predicts, as the Republican tax-cut plan sparks a stronger economy and mounting concerns about the federal deficit. All that could curb home buying.

MORE HOUSES AVAILABLE?

Meanwhile, the lofty prices should finally coax more prospective sellers to pull the trigger.

“Homeowners may be thinking prices are going to peak,” McLaughlin says.

Also, despite shortages of workers and lots, home builders are expected to ramp up construction to meet steady demand. Housing starts are projected to rise 2.2% next year to 1.3 million.

The result? More houses could come on the market even as buyers pull back.

TAX-CHANGE IMPACT

Then there's the tax cut package. The package signed into law by President Trump last week will cap the deduction for property and state and local income taxes at $10,000. That could particularly affect a state like New Jersey, which has the country's highest property taxes, a high state income tax and expensive homes.

On the margins, the prospect of a bigger tax bill may discourage some buyers and prompt some homeowners to sell and move to lower-tax states, says Nick Boniakowski, managing broker for Redfin in New Jersey.

That could moderate sharp price increases in hot markets with easy access to New York City and pose a further drag on values in less desirable areas of the state, he says. Already, he says, some buyers have canceled contracts in the hope of finding a better deal later in 2018.

The tax bill also caps the mortgage interest deduction at home values up to $750,000, down from $1 million, for homes bought after Dec. 15. The change will likely deter some high-end home purchases, particularly in California, Yun says.

NO LET-UP IN PRICE GAINS?

Neal Conatser, a Redfin broker in the San Francisco area, says the mortgage interest limit will more likely lead some prospective sellers to stay in their houses to hold onto their tax savings, further crimping supplies and pushing up prices in an already tight market.

In fact, Mark Fleming, chief economist at First American Financial, thinks the inventory crunch will worsen across the U.S. next year. Many homeowners, he says, are inclined to stay in place for fear of not finding another house in a competitive market or don’t want to take out a new, higher-rate mortgage.

Meanwhile, he forsees surging demand from Millennial first-time buyers as more enter their early 30s and realize bigger income gains. The homeownership rate for households headed by people under 35 increased to 35.3% in the second quarter from 34.1% a year earlier, according to Trulia and Census Bureau figures.

“All those renters want to buy homes,” Fleming says.

Despite the conflicting views, there are some signs that the market overall may cool. A recent Trulia survey shows that for the first time in four years, buyer optimism has waned: Just as many Americans think next year will be worse than the current year for buying a house as those who think it will be better. And nearly one in three said 2018 would be a better year to sell a home vs.14% who said it would be worse.

“We’re seeing waning interest in buying a home and greater interest in selling one,” McLaughlin says.

With fewer homes for sale today, would-be buyers are having to get creative about making their bid stand out. USA TODAY

Snoqualmie Pass Real Estate, Snoqualmie Pass Properties, Snoqualmie Pass Homes, Snoqualmie Pass Lots, North Bend Real Estate, Snoqualmie Real Estate, Suncadia Real Estate, http://www.snoqualmiepassliving.com

No comments:

Post a Comment